Understanding Medicare Supplement Insurance

Medicare Supplement Insurance, also known as Medigap, is designed to help cover some of the costs that Original Medicare does not. This includes expenses such as coinsurance, copayments, and deductibles. If you struggle with out-of-pocket expenses, you might find relief with a Medicare Supplement Plan. Here at Green Insurance Agency in Orange Park, Florida, we are committed to helping you navigate your options.

Am I Eligible for Medicare Supplement Insurance?

To be eligible for Medicare Supplement Insurance, you must first be enrolled in Medicare Part A and Part B. Typically, the best time to purchase a Medicare Supplement Plan is during your Medicare Supplement Open Enrollment Period, which begins the first month you're 65 and enrolled in Part B. This period lasts for six months and guarantees your eligibility for any plan sold in your area without medical underwriting. This means a Medigap Plan is considered "guaranteed issue" for you and you can not be turned down for any reason.

Understanding Medicare Supplement Insurance Costs

The cost of Medicare Supplement Insurance varies based on several factors including your age, gender, and the plan you choose. These Medigap policies are sold by private insurance companies and the premiums can vary widely. Remember that even though these plans are standardized, the price can differ. Therefore, shopping around can result in significant savings.

What is a Medicare Supplement Plan?

A Medicare Supplement Plan is meant to work with Original Medicare by covering certain out-of-pocket costs. These plans are different from Medicare Advantage Plans, as they do not cover additional benefits but rather supplement your Original Medicare coverage. Medigap plans are categorized by letters (A, B, C, D, F, G, K, L, M, N), and each type offers a different level of coverage.

Original Medicare and Medicare Supplement Insurance Plans

Original Medicare consists of Part A (Hospital Insurance) and Part B (Medical Insurance). While it covers many healthcare services, it doesn't cover everything. That's where Medicare Supplement Insurance Plans come in. These plans help pay for gaps in coverage, making healthcare more affordable.

Different Types of Medicare Supplement Plans

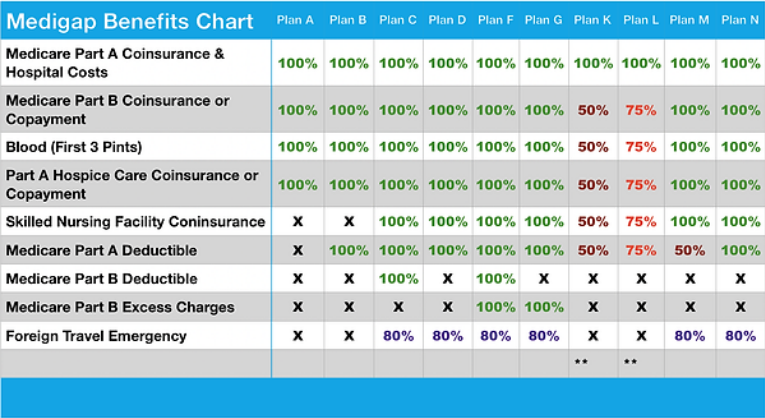

The 10 different types of Medicare Supplement Plans are compared below on the Medicare Supplement Plan Comparison Chart.

Each plan offers a different level of coverage, so it’s important to choose one that suits your healthcare needs and budget. For instance, Plan F offers comprehensive coverage but is no longer available to new enrollees as of January 2020.

How Medicare Supplement Insurance Plans Work

Medicare Supplement Insurance Plans work alongside your Original Medicare. They help cover costs such as copayments, coinsurance, and deductibles. They do not cover prescription drugs, which means you might need a separate Medicare Prescription Drug Plan (Part D) if you require medication coverage.

Enrolling in a Medicare Supplement Plan

To enroll in a Medicare Supplement Plan, you must be enrolled in Medicare Part A and Part B. Once you are eligible for Medicare during your open enrollment period, you can apply for a Medicare Supplement Insurance Plan. Private insurance companies offer these plans, so it's essential to compare prices and benefits.

Why You Might Need a Medicare Supplement

Medicare Supplements can be crucial if you have frequent medical appointments or high healthcare costs. These plans provide peace of mind by covering many expenses that Original Medicare does not. Without Medicare Supplement Insurance, you may face high out-of-pocket costs during emergencies or chronic illness treatments.

Applying for a Medicare Supplement Insurance Plan

If you are ready to apply for a Medicare Supplement Insurance Plan, contact one of our licensed insurance agents at Green Insurance Agency for guidance. We can help you find a plan that meets your specific needs.

Call us today at (904) 717-1176 to speak with a knowledgeable agent and receive personalized advice. Let us help you find the best Medicare Supplement Insurance Plan to fit your needs and budget.